A Deep Dive into ATS Corporation's Financial Strengths in the Booming Automatic Assembly Machines Market

ATS Corporation serves a diverse range of markets, including life sciences (medical devices, pharmaceuticals, radiopharmaceuticals, chemicals), transportation (electric vehicles, automotive, aerospace), food & beverage (processing, packaging, filling), consumer products (warehousing automation, cosmetics, electronics, durable goods), and energy (oil & gas, nuclear, solar, and other green energies). They engage with customers through greenfield and brownfield programs, focusing on regulated industries where quality and reliability are essential. ATS offers comprehensive services from the pre-automation phase to post-automation support, including engineering design, prototyping, process verification, and maintenance services.

1 . Company's Core Competency

- Global Presence: ATS has a broad geographic footprint, enabling it to serve multinational customers effectively.

- Technical Skills and Experience: With around 2000 engineers and 400 program management personnel, ATS has a wealth of expertise in delivering custom automation solutions.

- Product and Technology Portfolio: ATS owns an extensive portfolio, including linear motion transport systems, cam-driven assembly platforms, advanced vision systems, optical sorting and inspection technologies, and more.

- Recognized Brands: ATS's subsidiaries are well-known in their respective markets, enhancing its reputation and sales prospects.

- Trusted Customer Relationships: Many of ATS's customer relationships span over a decade, with repeat business highlighting the company's reliability and quality of service.

- Total-Solutions Capabilities: ATS's ability to provide comprehensive, turnkey automation solutions is a significant strength.

2 . Financial SWOT Analysis of ATS Corporation

Strengths:

- Revenue Growth: Revenue increased by 18.1%, totaling $2,577.4 million for fiscal year 2023.

- Order Backlog: The order backlog stood at $2,153 million, indicative of strong future revenue potential.

- Operational Efficiency: Investments in restructuring led to significant savings, with restructuring expenses of $27.5 million, higher than anticipated but aimed at long-term efficiency.

Weaknesses:

- Debt Level: The debt-to-equity ratio slightly increased from 1.14:1 in 2022 to 1.18:1 in 2023.

- SG&A Expense Management: SG&A expenses rose to $445.2 million from the previous year, reflecting a need for tighter expense control.

- Restructuring Overruns: Restructuring expenses were $27.5 million, surpassing the initial estimate of $20 to $25 million.

- Capital Expenditure Pressure: Cash investments in property, plant, and equipment totaled $56.1 million, reflecting significant capital commitments.

Opportunities:

- Market Expansion: Given the substantial order backlog and a focus on innovation, ATS has room to grow in both existing and new markets.

- Innovation and R&D: Total R&D investments signified by acquisitions of intangible assets amounted to $24.2 million, showcasing a commitment to innovation.

- Sustainability Initiatives: The ongoing trend toward sustainability presents opportunities for ATS to expand its product line and market reach.

- Economic Recovery: With economies recovering, demand in ATS's markets is expected to increase, potentially enhancing revenue growth.

Threats:

- Economic Uncertainty: Economic downturns and inflationary pressures could impact demand for ATS's products and services.

- Foreign Exchange Risks: With operations worldwide, ATS is exposed to currency fluctuation risks, which could impact financial results.

- Competitive Pressure: Increasing competition in ATS's markets could affect pricing, margins, and market share.

- Regulatory Changes: Evolving regulations across different jurisdictions could lead to increased compliance costs or operational restrictions.

3 . Financial Highlights of ATS

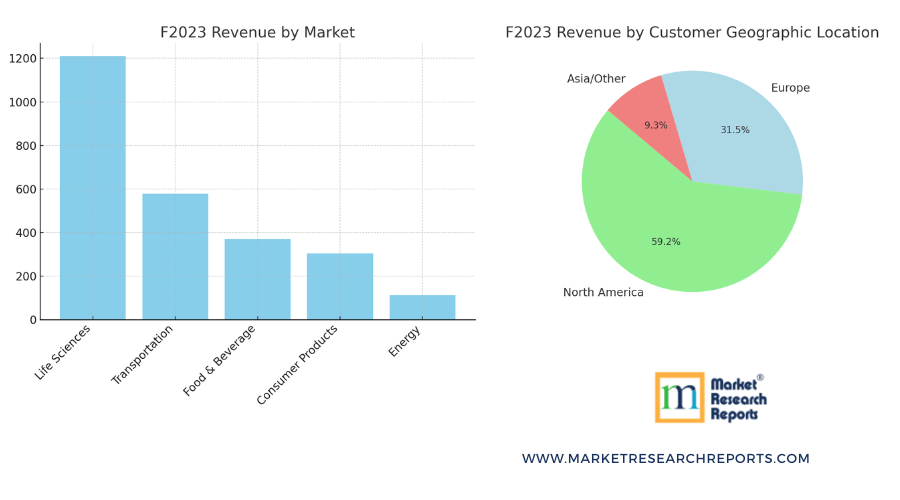

Revenue by Market for F2023:

- Life Sciences: $1209.9M

- Transportation: $578.2M

- Food & Beverage: $371.3M

- Consumer Products: $305.1M

- Energy: $112.9M

Revenue by Customer Geographic Location for F2023:

- North America: $1525.5M

- Europe: $811.7M

- Asia/Other: $240.2M

Total Revenue for F2023:

- $2577.4M

Segmented Disclosure:

- Operations are reported as one operating segment, Automation Systems.

- The geographic segmentation of revenues is detailed, with specific figures for property, plant and equipment, and intangible assets across different regions (Canada, United States, Germany, Italy, Other Europe, and Other).

F2023 Revenue by Market: This bar chart displays the revenue generated from different markets, showing a significant portion coming from Life Sciences, followed by Transportation, Food & Beverage, Consumer Products, and Energy.

F2023 Revenue by Customer Geographic Location: The pie chart illustrates the distribution of revenue based on customer geographic locations, with the majority coming from North America, followed by Europe, and a smaller portion from Asia/Other.

4 . Market Outlook for Automatic Assembly Machines:

ATS's position as a major manufacturer in the automatic assembly machines market is supported by its extensive product and technology portfolio, which allows for the development of unique and leading solutions. The company's focus on innovation, along with its recognized brand and global presence, positions it favorably in the market. The outlook for automatic assembly machines is positive, driven by:

- Increasing Demand for Automation: There's a growing demand for automation across various industries to improve efficiency, reduce costs, and mitigate labor shortages.

- Advancements in Technology: Continuous innovations in technology and the integration of Industry 4.0 practices are expected to propel the market forward.

- Focus on Customization and Flexibility: As manufacturers seek more customized and flexible solutions, ATS's ability to provide tailored automation systems becomes increasingly valuable.

- Sustainability and Efficiency: The push towards more sustainable manufacturing practices and the need for energy-efficient operations are expected to increase demand for automated assembly machines.

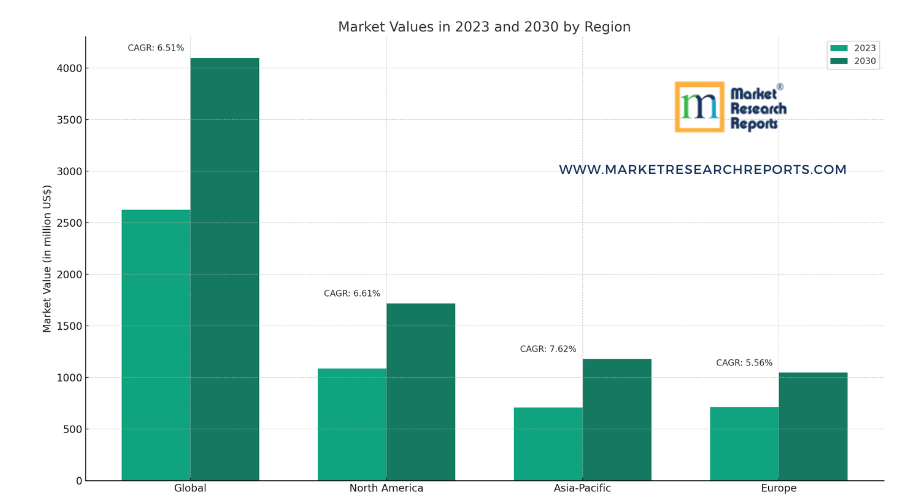

5 . Global Market Outlook

The visual representation above displays the market values in 2023 and their forecasted values in 2030 across the global market and specific regions (North America, Asia-Pacific, and Europe) for Automatic Assembly Machines. Additionally, the Compound Annual Growth Rate (CAGR) for each segment is annotated to indicate the growth rate from 2024 to 2030. Here are some key insights:

- Growth: The global market is expected to grow from $2,624.73 million in 2023 to $4,098.88 million by 2030, with a CAGR of 6.51%.

- Regional Growth Rates:

- North America: This shows a significant increase from $1,086.9 million in 2023 to $1,718.66 million by 2030, at a CAGR of 6.61%, indicating strong growth in the demand for automatic assembly machines.

- Asia-Pacific: Expected to experience the highest growth among the regions, from $707.63 million in 2023 to $1,178.43 million by 2030, with a CAGR of 7.62%. This growth can be attributed to rapid industrialization and the expansion of manufacturing sectors in the region.

- Europe: Forecasts growth from $712.61 million in 2023 to $1,046.85 million by 2030, with a CAGR of 5.56%, which is the slowest among the regions analyzed but still represents significant market expansion.

6 . Market Share and Competitive Landscape

In 2023, the top five global companies in the Automatic Assembly Machines market held approximately 38% of the market share in terms of revenue. This indicates a relatively concentrated market with key players such as Schaeffler Group, IMA Group, EMAG, Extol, U2 ROBOTICS, GEFIT, Advanced Manufacturing Development, and Haumiller playing significant roles. The concentration suggests that these companies have substantial influence over the market dynamics, innovation, and technological advancements within the industry.