Financial SWOT Analysis of Toyota Motor Corporation

Table of Contents

A financial SWOT analysis is crucial because it provides a focused lens on a company's financial health and strategic positioning, which are foundational to its overall success. By evaluating financial strengths and weaknesses, it highlights the company’s ability to fund growth initiatives, manage debt, and withstand economic fluctuations. Identifying opportunities and threats in the financial context helps in strategic planning, risk management, and capital allocation.

Based on the annual report and financial data available on the company's website, we have conducted a comprehensive SWOT analysis focusing on Toyota's financial performance and position in FY2023, incorporating data analysis to identify specific strengths, weaknesses, opportunities, and threats.

1 . Strengths

Increased Sales and Market Share: Toyota's consolidated vehicle unit sales in Japan and overseas increased by 591 thousand units or 7.2% to 8,822 thousand units in FY2023 compared with FY2022. This demonstrates Toyota's ability to grow its market share and sales volume in a competitive market.

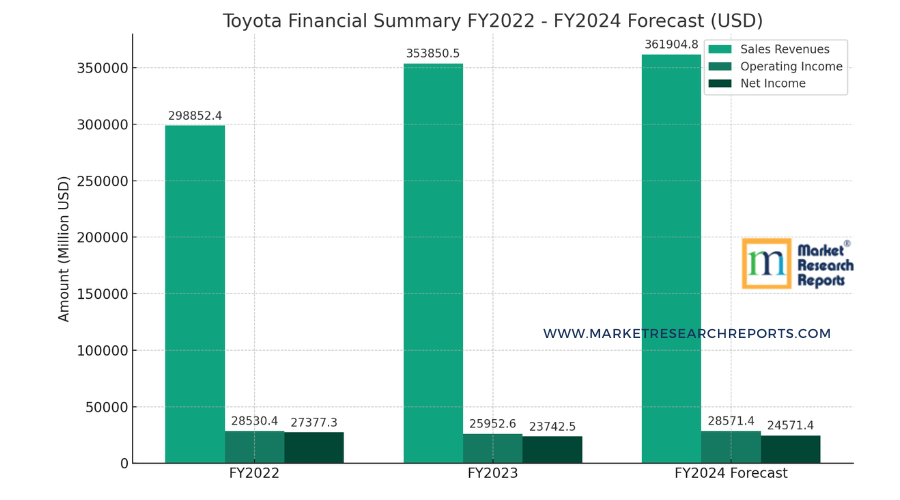

Revenue Growth: Toyota reported a significant increase in sales revenues, reaching 37,154.2 billion yen in FY2023, marking an increase of 18.4% compared with FY2022. This robust growth in sales revenue is a clear indicator of Toyota's strong market demand and successful product offerings.

Global Presence and Brand Power: Leveraging long-selling brand power like "The Crown" and "GR Corolla", Toyota has managed to maintain a competitive edge, showcasing its global presence and brand strength.

Strong Balance Sheet: Toyota's total assets increased from 67,688.77 billion yen in FY2022 to 74,303.18 billion yen in FY2023, indicating a robust financial position and the ability to invest in growth opportunities.

High Shareholders' Equity: The shareholders' equity per share increased from 1,904.88 yen as of March 31, 2022, to 2,089.08 yen as of March 31, 2023, reflecting a strong equity base and financial stability.

- Liquidity and Financial Flexibility: The increase in cash and cash equivalents from 4,299.52 billion yen at the end of FY2022 to 5,548.4 billion yen at the end of FY2023 demonstrates Toyota's strong liquidity position, enhancing its ability to respond to opportunities and challenges.

2 . Weaknesses

Decrease in Operating and Net Income: Despite revenue growth, Toyota experienced a decrease in operating income by 9.0% and net income attributable to Toyota Motor Corporation by 14.0% in FY2023 compared to FY2022. This indicates pressure on profitability margins, possibly due to rising costs or increased investments.

Cost Management Challenges: The detailed financial results reveal challenges in cost management, with cost reduction efforts leading to a decrease of 1,290.0 billion yen and expense reduction efforts decreasing by 525.0 billion yen, negatively impacting operating income.

Increased Liabilities: Total liabilities rose from 40,533.95 billion yen in FY2022 to 45,038.97 billion yen in FY2023, indicating an increase in financial obligations that could impact future profitability and cash flow.

- Dependency on Debt Financing: The increase in both current and non-current liabilities suggests a reliance on debt financing, which could pose risks if interest rates rise or if there are significant economic downturns.

3 . Opportunities

Electric and Hybrid Vehicle Market Expansion: Toyota's commitment to expanding its lineup with profitable HEVs, PHEVs, and BEVs positions it well to capitalize on the growing global demand for environmentally friendly vehicles.

Strategic Investments in Technology and Innovation: Toyota's emphasis on leveraging the Toyota Production System (TPS) for cost reductions and Kaizen, alongside investments in mobility and BEV areas, presents significant opportunities for future growth and industry leadership in innovation.

Emerging Market Growth: Toyota's strategic focus on emerging markets as a source of income and its goal to achieve a value chain of approximately 10 million units sold underscore its potential to tap into new business opportunities globally.

Capital Investment for Growth: Toyota's strong balance sheet and cash reserves provide ample opportunities for strategic investments in research and development, particularly in electric vehicles (EVs) and autonomous driving technologies.

4 . Threats

Economic and Market Fluctuations: The automotive industry is highly susceptible to global economic conditions, market demand fluctuations, and competitive pressures. Toyota faces the challenge of navigating these uncertainties while maintaining its market position.

Soaring Material Prices: The financial summary highlights the adverse impact of soaring material prices, particularly in regions like Central and South America, Oceania, Africa, and the Middle East, where operating income decreased by 2.9% in FY2023 compared to FY2022. This trend poses a threat to Toyota's cost structure and profitability.

Regulatory and Environmental Challenges: As global emphasis on environmental sustainability intensifies, Toyota must navigate evolving regulatory landscapes, which could impose additional costs and challenges in maintaining compliance and pursuing carbon neutrality goals.

Rising Debt Levels: While Toyota's financial position is strong, the increase in total liabilities necessitates careful debt management to avoid over-leverage, which could become a threat in volatile economic conditions.

- Interest Rate Risk: As interest rates fluctuate, Toyota's cost of debt could increase, impacting its profitability and financial stability. This is particularly relevant given the current global economic uncertainties and potential for rising interest rates.