Retail Banks are Banking upon Cloud for Success

Retail banks have mostly migrated to the cloud; this collaboration proves beneficial. Banks have noticed their increased uptime, improved scalability, and degree of automation that are inherent to cloud computing models. But why did the banks decide to move to the cloud?

Fintech companies do not threaten banks, but the changing behavior of customers does.

The fintech companies, by the very nature of their origin, are fast to adopt new technologies. Fintech does not feel overly dependent on one platform for accomplishing all financial needs; instead, using next-gen technologies, they focus on customer retention through speed and convenience. Today, Millenials are a bit restless in comparison to their preceding generation. They are bright, multitasking, and want someone who understands and listens to their concerns thoughtfully.

Kathleen Holm, Marketing Director of the TCS Digital Software & Solutions (DS&S) Group, says, "Cloud computing can help solve this problem. Used in conjunction with big data solutions, the cloud makes it easier to aggregate and serve up all customer data in one place, in real-time."

The Global Cloud Migration Services market size is expected to gain market growth in the forecast period of 2020 to 2025, with a CAGR of 13.3% in the forecast period of 2020 to 2025 and will expected to reach USD 6025.7 million by 2025, from USD 3657.4 million in 2019

Cloud offers a consistent and seamless experience across devices and channels, ensuring data from any customer touchpoint is available. Suppose a customer wants to access the banking software/app on the go; he can access it while traveling to his workplace or enjoying a vacation abroad with family using their mobile phone or computer. Applications hosted on the cloud receive incremental updates; these updates further enhance existing applications, fix bugs, and add additional security layers.

Retail banks can get the following benefit by migrating to clouds:

- Pocket Friendly: Retail banks can turn sizeable up-front capital expenditure into a more minor, ongoing operational cost.

- Pay as you go: Investment in the cloud can be a part of ongoing operational costs. There is no need for heavy upfront investment in new hardware and software.

- Business up-time: With the cloud, banks gain a higher level of data protection, fault tolerance, and disaster recovery.

- Business agility: Shorter development cycles for new products support timely response to the needs of banking customers

- Reduction in Carbon Footprint: Cloud computing transfers services to a virtual environment that reduces energy consumption and carbon footprint.

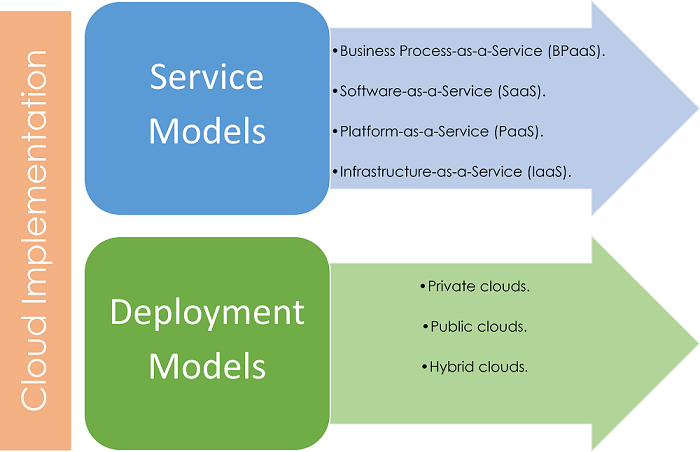

Choosing the cloud service which best suits the requirement:

The leading cloud providers offer innovative products that can be accessed on their platforms and help banks implement business and operating models to improve revenue generation.

- Business Process-as-a-Service (BPaaS): The banks can use this service for standard business processes such as billing, payroll, or human resources.

- Software-as-a-Service (SaaS): A cloud service provider hosts the business software and related data via their web browser. Types of software that can be hosted are accounting, CRM, ERP, invoicing, Staffing, etc.

- Platform-as-a-Service (PaaS): A cloud service provider offers a complete platform for application, interface, database development, storage, and testing.

- Infrastructure-as-a-Service (IaaS): Cloud service providers allow businesses to buy resources such as servers, software, data center space, or network equipment as a fully outsourced service.

Cloud service providers generally deploy cloud models in three ways:

- Private clouds: The cloud infrastructure is organized exclusively for a specific company.

- Public clouds: The cloud infrastructure made available to the general public or a large industry group

- Hybrid clouds: The cloud infrastructure is composed of two or more clouds (private or public)

Real-World Example: How Citigroup slashed server provisioning times from 45 days to less than 20 minutes, With the help of IBM solution

The Problem: Citigroup wanted to dramatically reduce time to market by rapidly accelerating development cycles for the company’s more than 20,000 internal application developers, who were typically forced to wait up to 45 days for server resources to be provisioned.

The solution: Citigroup built a private cloud using IBM® Cloudburst™ and Tivoli® software solutions, enabling self-service requests, automated provisioning, and internal chargeback capabilities while at the same time boosting utilization rates and improving operational efficiencies.

Citigroup has provisioned more than 550 virtual machines in the cloud so far, and demand for the new service continues to grow. For example, Citigroup is now taking full advantage of the cloud development environment to support a significant development project for the company’s retail banking experience.

Source: IBM